¡Descubre la Tarjeta de crédito Evo Banco!

Credit card without annual fee and with many special benefits in Spain!

When it comes to credit cards, it is important to choose the one that best suits your lifestyle and needs. That’s why it’s important to know the advantages of the Evo Banco Smart Card.

Choose the payment method established on your card and you can make your purchases with peace of mind.

If you want to know the details so you don’t miss out on this offer, we’ll explain everything below.

Features of the Evo Banco credit card

The Evo Banco card has the following main features:

- Total ease for your daily purchases;

- Convenience to apply online;

- Completely free and will never charge fees for issuance or maintenance;

- Dual function: Debit and Credit;

- Flexible payment mode: daily, end of the month, or deferred;

- Cash available at ATMs in Spain and around the world;

- Free insurance for protected purchases, travel, and accidents.

How does my Evo Banco Smart Card work?

The Evo Bank Smart Card is completely free and has no issuance or maintenance costs. This is one of the best advantages of this card, as the customer does not need to worry about extra payments.

It also has super flexible payment methods in three different modalities, which are daily payment, end-of-month payment and installment payment. Now, let’s explain:

- Daily payment: it is like a debit card where your purchases are charged to your account at the end of the day.

- End-of-month payment: like a credit card, but without having to pay more. In this modality, all your purchases are always charged on the 5th of the following month at no extra cost, with 0% APR and 0% EAR.

- Installment payment: also known as revolving payment, allows customers to pay in installments and decide whether they want to pay a fixed amount per month or a significant percentage with 18.36% APR and 19.99% EAR.

And that’s not all! There are also other payment methods available on this card. In addition to paying the full amount at the time, the customer can also defer the payment up to 18 months according to the purchase. Remember that in each purchase, you can see the available deadlines.

About the issuer of the Evo Banco Smart Card

EVO Banco is a Spanish digital bank that was established as a commercial brand in 2012 and is headquartered in Madrid.

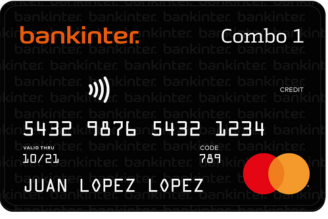

In 2019, it was acquired by Banco Bankinter and has been under its ownership since then.

Brand

The Evo Banco Smart Card is backed by VISA, one of the most well-known brands worldwide, accepted internationally, providing more security and making life easier for customers.

Annual Fee

As already clarified, this credit card is completely free of maintenance costs, whether annual or monthly.

Minimum income to apply for Evo Banco credit card

The official website of the financial institution does not mention minimum income values to apply for this card.

Approval Time

The entire process of processing this credit and debit card occurs online, in a practical way, and is completed in a few minutes. If approved, you will receive the card at your home within 15 days.

From what age can it be requested?

This card is available from 18 years of age.

Credit limit

The credit limit depends on each customer’s profile and will be informed at the time of application.

Advantages and disadvantages of the Evo Banco credit card

This card offers various benefits and for that reason, it is an excellent credit alternative. But, in addition to the advantages, it is also important to consider the disadvantages, as we discuss below.

Advantages of the card

- No issuance or maintenance fee;

- No opening commission;

- More flexibility in payments;

- Accepted at various businesses in Spain and abroad;

Disadvantages of the card

- It does not offer any long-term bonus program.

Do you want to know how to apply for this credit card? Then, here you will see the complete step-by-step process to apply for this card.